Are you having trouble saving money? You’re not alone. Research suggests that an alarming number of Americans are not too savvy when it comes to saving.

A recent survey by GoBankingRates.com revealed that 30 percent of households have savings balances of zero, while 21 percent have no savings accounts at all.

Another study by the Federal Reserve showed that more than 50 percent of households have less than a month’s worth of income set aside for emergency expenses. Most financial advisers suggest you have at least six months worth of income set aside at any given time.

With mounting debt and interest, saving money can seem nearly impossible. But all it takes is some discipline and a little know-how. Here are 16 tips to get you started.

[adinserter block=”3″]

[adinserter block=”8″]

1. Open a Savings Account

You can open a savings account through your bank, but it’s best to shop around for one that’s best for you. Online banks typically offer better yields than their brick-and-mortar counterparts.

The average annual percentage yield (APY) for savings accounts stands at a dismal .06 percent, and some of the country’s biggest banks offer rates as low as .01 percent. Online banks like Ally and Synchrony currently offer rates of at least 1 percent. This doesn’t mean you’re going to get rich off your personal-savings account. But it’s better to keep your earnings where it can collect some interest rather than keeping it at home, where it collects only dust.

Consider this: Keeping a balance of $10,000 in a savings account with 1 percent yield gets you $100 each year, while storing it an account with .01 percent yield earns you $1 per year.

[adinserter block=”7″]

[adinserter block=”2″]

2. Automate Savings

Set a certain amount to be automatically transferred from your checking account into your savings account every month or each time a check comes in. Don’t rely on yourself to put money into your savings account or you’ll be tempted to spend it.

If you don’t see it in the first place, you’re not going to miss it.

[adinserter block=”3″]

[adinserter block=”8″]

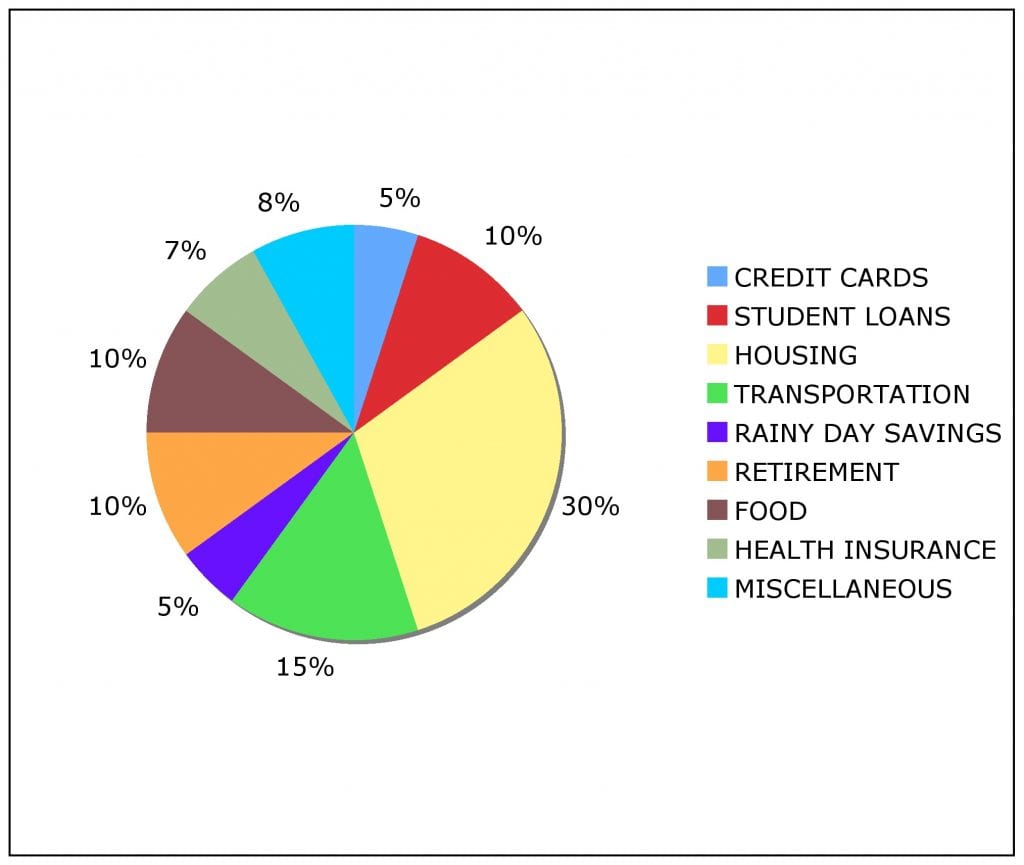

3. Set Up A Budget

According to MoneyCrashers.com, 40 percent of American families don’t have monthly budgets. However, setting one up is easier than you may think.

Start by tracking your monthly expenses. Keep a month’s worth of receipts and refer to the last month’s credit/debit card history. Also, analyze your monthly bills and minimum payments. Break down expenses into categories such as transportation and groceries. You decide how broad or specific they can be.

Next, figure out your monthly income after taxes. If your earnings fluctuate throughout the month, average out the last six to 12 months worth of recurring income to get a general picture.

Finally, place this data into online software like Microsoft Excel or apps such as You Need a Budget or Mint. These apps can connect to all your financial accounts and update your budget as the numbers change. They can give you a clear, digital picture of where your money is going and where you can scale back.

[adinserter block=”7″]

[adinserter block=”2″]

4. Evaluate Your Monthly Bills

Sit down and take a long, hard look at all of your monthly bills: phone, cable, gym, etc. Ask yourself if each payment is worth what you’re getting.

How often do you watch cable TV? Can you watch all your favorite shows online for free or through cheaper streaming services like Netflix and Hulu? When was the last time you went to the gym? YouTube alone offers thousands of home-exercise videos. Do you really need a landline phone? It’s not 1996 anymore (unfortunately).

Keep only what is valuable to you and slash everything else. Then, it’s time to lower your monthly bills.

[adinserter block=”3″]

[adinserter block=”8″]

5. Renegotiate Monthly Bills

Believe it or not, many of the monthly payments you’re making can be reduced. If you’re paying student loans, for example, you may be able to lower your monthly payment to something that better suits your income.

You can also cut your phone bill by shopping around for better plans or switching to a prepaid option. When it comes to your cable bill, consumer expert Clark Howard suggests you shop the competition.

After you get an offer from another service provider, ask for an email confirmation detailing what you’re being offered and what you’ll be charged. Then, call your current provider and say you’re ready to drop their service because you found a better option. Afterward, you’ll be transferred to a customer retention specialist who has the authority to negotiate with you.

[adinserter block=”7″]

[adinserter block=”2″]

6. Build a Debt-Payment Plan

Mounting debt can take a catastrophic toll on your financial wellness if it’s not addressed properly. Consider taking a thorough look at your debt, earnings and savings to come up with a plan for tackling debt.

First, aim for high-interest debt such as credit card payments. The latest BankRate data puts the average fixed-interest rate for credit cards at 11.6 percent. Using the latest records from the U.S. Census Bureau and the Federal Reserve, ValuePenguin.com reported that the average credit card debt for American households is $5,700.

So tackle this debt sooner than later. One way to do it is to set small goals over time. For example, you may find that you can pay off one credit card by a certain month if you cut back on some unnecessary expenses.

[adinserter block=”3″]

[adinserter block=”8″]

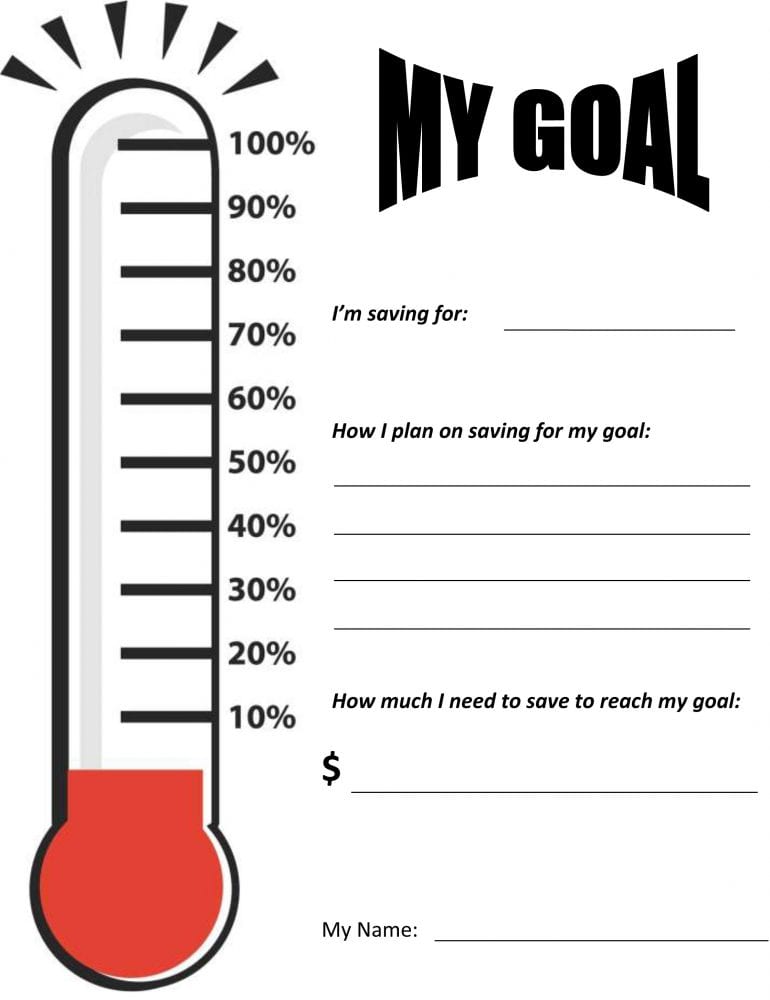

7. Set Your Goals In Front of You

Studies show that saving money is a lot easier when you have set financial goals to reach. So always keep your eye on the prize. Think of at least three major goals you want to accomplish with your savings. Jot them down on index cards or store them on your phone. Just make sure they’re always accessible.

When you feel tempted to splurge, look back at these and think about how that spending will affect your goals. Every Time you make money, think about how closer you’re getting to meeting these milestones.

Each goal should follow the S.M.A.R.T. criteria (Specific, Measurable, Attainable, Realistic, Time Oriented).

[adinserter block=”7″]

[adinserter block=”2″]

8. Cut Back on Stuff

Making sacrifices is never easy. But think about your overall financial wellness and the goals you’ve set for your savings.

Many financial planners suggest you avoid expenses such as going out for dinner frequently and buying name-brand products. So take a look at your expenses and identify where you can cut back. This doesn’t mean you have to stop treating yourself. It’s simply a matter of quantity.

If you like eating out, for example, do it once a week rather than every day.

“The No. 1 rule of setting budgets is to not cut all the fun out of your life,” said consumer-education expert Jim Tehan in an interview with BankRate. “Inevitably, Spartan budgets that have no allowance for entertainment are doomed to fail … It’s not about cutting out everything that gives you joy in life. It’s about better allocating your money.”

[adinserter block=”3″]

[adinserter block=”8″]

9. Avoid Using Plastic

You’ll be surprised how much easier it is to save money when you’re using cash instead of a credit or debit card. The issue with using plastic for all your transactions is that you don’t actually see your hard-earned cash disappearing. So it’s easy to swipe away and splurge without stopping to think about what you’re really losing.

According to a study by Dun & Bradstreet, people spend 12 to 18 percent more money when using credit cards as opposed to cash. So leave your card at home and set it to pay monthly bills. Withdraw a certain amount from no-fee ATMs each month to cover everything else. Afterward, put that cash in envelopes and use it for your necessities– and a little fun of course.

“By spending cash out of an envelope, you begin to get a better feeling of where your money is going and what your priorities really are,” said CFP professional Martin Siesta in an interview with BankRate.

[adinserter block=”7″]

[adinserter block=”2″]

10. Spend Less on Food

Instead of going out to eat, cook at home. Make meals that can be stored in a freezer for later. Keep perishables visible in front of the refrigerator.

Before you go grocery shopping, make a list and look for relevant coupons online or through apps. Buy clearance meat as retailers tend to drop meat prices by 30 to 50 percent as they near their expiration dates. Make sure you store these in the freezer as soon as possible. Also, buy generic brands of your favorite foods.

Another helpful option is to buy what’s on sale. Clark says you can cut your grocery bill by about 30 percent if you base your shopping list around what’s on sale.

Buying in bulk is another great option, but only if you do it right. Make sure you will manage to use every item before its expiration date, and check per-ounce prices to ensure you’re really getting a bargain.

[adinserter block=”3″]

[adinserter block=”8″]

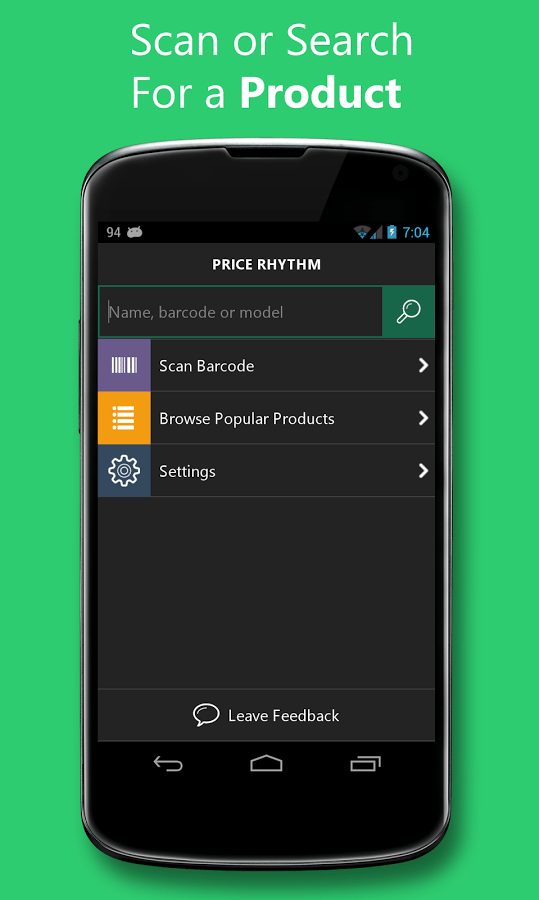

11. Use Price-Comparison Apps

Who doesn’t want to save money on the stuff they buy on a regular basis?

With dozens of price-matching apps at your disposal, it has never been easier. Consider using options like PriceGrabber, RedLaser or ShopSavvy. You can use the latter to scan a barcode or search for a product. The app will then show you where you can find that product near you or online for the cheapest price.

Major retailers like Bestbuy and Walmart have price-matching solutions built into their websites or mobile apps. The Walmart app’s Savings Catcher feature lets you scan your receipts to find better deals on your purchases. If it finds cheaper prices at competing retailers, you’ll get the price difference on a gift card.

You can also download price-matching extensions onto your browser. When you’re shopping online, plug-ins like InvisibleHand will open up a drop menu letting you know where you can find the product you’re looking at for a cheaper price. It even applies to flights and hotels.

[adinserter block=”7″]

[adinserter block=”2″]

12. Use Key Ring Apps

If you normally shop at major retailers, chances are you’re enrolled in one of their rewards programs. If you’re not, consider signing up for one. It’ll help you save money in the long run. However, carrying multiple cards on your keychain can become a hassle especially when you’re on line at a store and you’re trying to find the right one.

Apps like KeyRing organize them all on your phone. You can also use it to organize coupons, weekly ads and shopping lists.

[adinserter block=”3″]

[adinserter block=”8″]

13. Manage Online Promotions

If you feel tempted to splurge every time you hear of sales at your favorite stores, try steering away from promotional emails you may have unwittingly signed up for. Apps like Unroll.Me and Sanebox can ease the process of unsubscribing from promotional emails you don’t want.

[adinserter block=”7″]

[adinserter block=”2″]

14. Take Advantage of Freebies

Free stuff is all around you. Whether it’s free admission to a local museum or free access to an outdoor concert, free fun may be right around the corner. And with the Internet at your fingertips, it’s never been easier to find the freebies nearest you.

Get on Google and search “fun things to do for free” in your area. Then, start marking up your calendar.

[adinserter block=”3″]

[adinserter block=”8″]

15. Take Advantage of Employer Benefits

If you’re fortunate enough to have access to employer benefits, take advantage of these options. Look into your company’s retirement savings accounts or flexible spending accounts. Be aware of any financial-literacy programs, tools, or resources your employer may offer. You may be able to get free financial counseling.

Research by the University of Massachusetts suggests financial literacy is crucial for anyone who expects to build wealth over time.

[adinserter block=”7″]

[adinserter block=”2″]

16. Save Early for Retirement

Most financial planners suggest you start saving by age 25. But for the 20-something who is struggling to make rent while paying off student-loans or even finding a job, this can be easier said than done.

Nonetheless, it’s worth the investment no matter how small. And the sooner you start making it, the better.

Consider this. Starting at age 25, you invest $2,000 a year for 40 years. Assuming an 8 percent annual growth, you’ll have $560,000 in earnings at age 65. Now, say you invest the same amount for 30 years beginning at age 35. At 65, you’ll have $245,000—or less than half the earnings.

So if your employer offers 401(k) plans, start contributing now. If you can’t enroll in a 401(k), opt for a Roth IRA. Also, consider investing in stocks.

No matter what your age, start becoming as financially literate as possible. Read financial websites and books, speak to a financial planner, see if you’re job offers any financial-planning resources. You’ll walk away with insight that will fuel your financial wellness for the rest of your life.

[adinserter block=”3″]

[adinserter block=”8″]

17. BONUS BOOST

Here is a list of other quick ways to save money.

Bring lunch to work

Make your own cleaning products like detergent

Entertain indoors as often as possible

Skype instead of making long-distance calls

Turn off roaming and rely on Wi-Fi when traveling

Look through receipts to ensure you weren’t overcharged and keep them in case of returns

Refill printer ink instead of buying new cartridges

Vacation closer to home and travel during off-peak season

Contribute windfalls such as tax refunds or raises toward savings

Eat well and exercise to avoid paying with your health further down the road

I hope this post helped. Do you have any money-saving tips not mentioned? Please share in the comments below. And remember …

[adinserter block=”7″]

[adinserter block=”2″]